I don't like being in that many positions all at once. It makes me jittery. Thank goodness, once again, that I tend to follow rules. We did get a buy signal on the Gbp/Jpy which goes against the short Usd/Jpy signal. Probably just an indication of a very strong Gbp and a weak Usd, not necessarily a reflection on the Jpy. If you note the other quick postings you will see the other new trades.

I am tightening my stops a little more than I customarily do, primarily because I am tired and we are going into the weekend. I think all of these could still run after a breather but I need a breather too, not just because of trading but life in general.

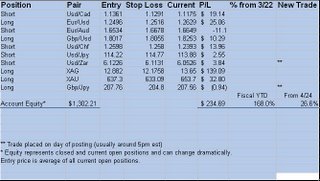

So here it is, current standings, still soaring. Have a fantastic weekend.

Blake Young

Random Acts of Forex