Thursday, May 11, 2006

Updated Positions

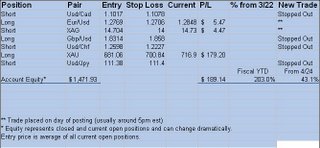

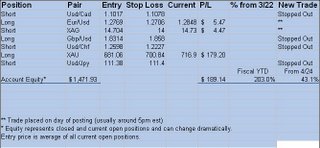

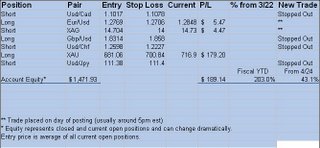

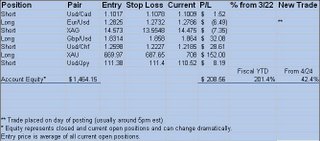

Got stopped out of most of the trades during the night. Re entered Silver and the Eur/Usd both long. See positions. I will try to write some comments on the week to come tomorrow. Remember trade balance is due out tomorrow. I may scalp a little in the morning if we get a strong movement.

Wednesday, May 10, 2006

Wild ride from the FOMC

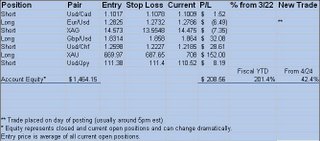

Up and down up and down,... up??? The news appeared to have a net zero effect on the market. Lots of whip saw on the event. I was stopped out of the Eur/Usd again and then got back in. So I grabbed a couple of dollars and re-entered the trade. Also added to the Gold and back in on Silver. Remember you can trade IAU and SLV if you would like to trade the ETFs/iShares for gold and silver.

We are back over 200% again and still have 2 weeks to go for the end of month two. With gold and silver breaking out, I think we have a good chance.

Good luck in your trading.

Blake Young

Random Acts of Forex

We are back over 200% again and still have 2 weeks to go for the end of month two. With gold and silver breaking out, I think we have a good chance.

Good luck in your trading.

Blake Young

Random Acts of Forex

Tuesday, May 09, 2006

Testing Barriers and stop losses

This morning there has been a bit of volatility as many currency pairs have pushed to the years or multiple year extremes. These attempts have included a bit of volatility and I have been stopped out of a number of trades and still have signals to get back in to the trades. This can be aggravating to be stopped out and have the trend continue, but it is better than taking to much risk. So, even though I was stopped out of the Eur and the Cad, I am back in those trades.

I have added to my gold position as gold makes an attempt at $700. This could be big. About 6 months ago I commented to a number of trader friends that I wouldn't be surprised if gold broke $1000 within 2 years. It certainly appears to be headed that direction.

Now pay attention here. FOMC Interest rate announcement. What is it going to be? Even though Bernanke said he may be done raising rates, analysts are expecting we are going to get another rate hike to put the discount rate to 5%. If the analysts are right and the market is expecting this, imagine the implication if there is a no rate hike. If the market has priced in the hike and their is no hike, we could see 150-200 pip move after the announcement. The question is, is the Eur/Usd reflecting expectations of a hike, no hike as Bernanke hinted at, or something in between. No matter what happens, I expect a lot of action tomorrow. Maybe a good scalping time. This could be another reason to play gold, due to uncertainty.

Below are the current positions. Note the entry price has changed due to new positions or adding to previous positions.

I have added to my gold position as gold makes an attempt at $700. This could be big. About 6 months ago I commented to a number of trader friends that I wouldn't be surprised if gold broke $1000 within 2 years. It certainly appears to be headed that direction.

Now pay attention here. FOMC Interest rate announcement. What is it going to be? Even though Bernanke said he may be done raising rates, analysts are expecting we are going to get another rate hike to put the discount rate to 5%. If the analysts are right and the market is expecting this, imagine the implication if there is a no rate hike. If the market has priced in the hike and their is no hike, we could see 150-200 pip move after the announcement. The question is, is the Eur/Usd reflecting expectations of a hike, no hike as Bernanke hinted at, or something in between. No matter what happens, I expect a lot of action tomorrow. Maybe a good scalping time. This could be another reason to play gold, due to uncertainty.

Below are the current positions. Note the entry price has changed due to new positions or adding to previous positions.

Monday, May 08, 2006

At a live event.

Do to presenting and the time required involved in the class, I am going to do my best to update this but updates may be late or missing while here. I will send an email for every update between now and Friday if you are on the email list.

Thanks for your understanding

Blake Young

Random Acts of Forex

Subscribe to:

Comments (Atom)