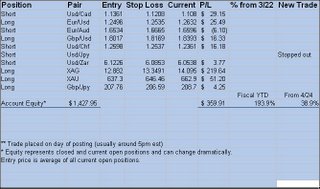

I was stopped out of the Usd/Cad due to volatility. I have an entry order at 1.1017, allowing a break below the lows.

I am looking at placing an entry order on gold and silver, both long of course. I haven't decided at what level to place it yet. We will see.

We haven't recovered all the uncaptured gains yet but we are still doing well and on track,and uncaptured doesn't count until you close it out.

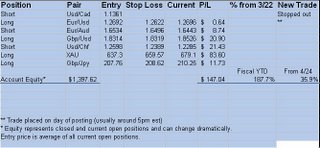

Below are the current positions and current stop losses.

Have fun with the announcement. It could define the dollar.