Friday, March 24, 2006

Escaping from Dollars, Safety in Gold

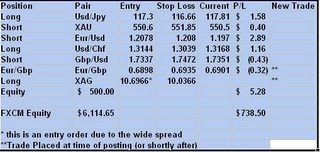

New home starts came in lower than anticipated today, 1.08mm actual versus 1.20mm expected. This pull back in new home starts appears to be what moved the dollar today. My guess is that not only does it reflect a slow down in the real estate market in the US but it also confirms the lower PPI and CPI that the economy may be slowing which would encourage no rate hike.

Many investors have felt that more rate hikes were coming up. The numbers showing no justification to a rate hike would decrease the demand for the dollar and the increased demand in gold.

I flipped the gold trade as explained earlier. My anticipation is that the run for gold could last a week or more. The surprising thing is we were not taken out of any of the other trades. I tightened the stops on all the trades and we will see where this goes now.

The EUR/AUD bounced back up and looks like it set up for another run. Hopeful hundreds of pips run like last time.

Many investors have felt that more rate hikes were coming up. The numbers showing no justification to a rate hike would decrease the demand for the dollar and the increased demand in gold.

I flipped the gold trade as explained earlier. My anticipation is that the run for gold could last a week or more. The surprising thing is we were not taken out of any of the other trades. I tightened the stops on all the trades and we will see where this goes now.

The EUR/AUD bounced back up and looks like it set up for another run. Hopeful hundreds of pips run like last time.

Flipped gold position from short to long

Flipped the trade over. Gold is running up

I will post the trades and positions tonight.

I will post the trades and positions tonight.

Thursday, March 23, 2006

Beginning of a new day

The day rolls over at 5pm est and we are in one trade and waiting for another. Very bullish short term for the USD. I find it intriguing that gold is moving opposite of silver. Silver has been a rocket over the past 6 months.

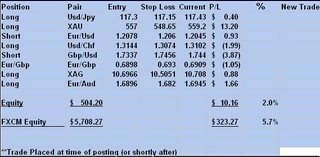

You will notice the difference in the smaller account and the larger account. This is partially due to the slightly larger positions as a percentage in the larger. Don't let this sway you into playing bigger trades. Though this is great during a run, going larger on your account risk can destroy you in a drawdown period.

You will notice the difference in the smaller account and the larger account. This is partially due to the slightly larger positions as a percentage in the larger. Don't let this sway you into playing bigger trades. Though this is great during a run, going larger on your account risk can destroy you in a drawdown period.

Down the Rabbit Hole

I feel a little bit like I am going down the rabbit hole with my new effort.

Effective 3-22-06, I will be posting all of my trades and running account values using some money management.

I have had people ask if it is possible to trade the forex with very little money. I am going to trade a $500 account with a dealer that allows base 10 or unit based trading.

What does unit based trading mean? This means that if I have $500 (493.60 after transfer fees) account and have a trade where I would normally place 2.5% at risk, I can actually invest $12.50 in the trade by investing 1,250 units or 12.5% of a mini contract. Unit trading allows exact money management.

For those that are using a dealer that trades based on mini and full size contract, I will be starting with $5385 and be buying 2 mini contracts for most trades.

I decided it is time to show that a conservative approach in the currency market can still generate good returns whether you are trading a small account or if you are trading a large account. As such I will not post my scalps or more other account, just the accounts as described above.

Because I am posting account results, I may miss a trade posting but all trades can be verified by the account report.

Be aware that if I post a trade late I will post my actual entry price and exit price and can verify the time if you are interested. There may be a little disparity between the two accounts as I am manually placing the orders and stops and they have different spreads.

The smaller account allows for trading the spot gold and spot silver markets as well as the South African Rand (Usd/Zar) where the FXCM $5385 does not. I will be taking gold and silver and USD/ZAR trades on the smaller accounts.

My current positions consist of:

Position

Pair

Entry

Stop Loss

Current

Long

Usd/Jpy

117.3

116.42

117.69

Short

XAU (gold)

550.6

552.90

551.00

Short

Eur/Usd

1.2078

1.2109

1.1979

Short

Usd/Zar

6.2729

6.3299

6.3034

Long

Usd/Chf

1.3144

1.3115

1.3160

Short

Gbp/Usd

1.7337

1.7400

1.7361

Current Equity

$494.33

Current P/L

$0.69

Effective 3-22-06, I will be posting all of my trades and running account values using some money management.

I have had people ask if it is possible to trade the forex with very little money. I am going to trade a $500 account with a dealer that allows base 10 or unit based trading.

What does unit based trading mean? This means that if I have $500 (493.60 after transfer fees) account and have a trade where I would normally place 2.5% at risk, I can actually invest $12.50 in the trade by investing 1,250 units or 12.5% of a mini contract. Unit trading allows exact money management.

For those that are using a dealer that trades based on mini and full size contract, I will be starting with $5385 and be buying 2 mini contracts for most trades.

I decided it is time to show that a conservative approach in the currency market can still generate good returns whether you are trading a small account or if you are trading a large account. As such I will not post my scalps or more other account, just the accounts as described above.

Because I am posting account results, I may miss a trade posting but all trades can be verified by the account report.

Be aware that if I post a trade late I will post my actual entry price and exit price and can verify the time if you are interested. There may be a little disparity between the two accounts as I am manually placing the orders and stops and they have different spreads.

The smaller account allows for trading the spot gold and spot silver markets as well as the South African Rand (Usd/Zar) where the FXCM $5385 does not. I will be taking gold and silver and USD/ZAR trades on the smaller accounts.

My current positions consist of:

Position

Pair

Entry

Stop Loss

Current

Long

Usd/Jpy

117.3

116.42

117.69

Short

XAU (gold)

550.6

552.90

551.00

Short

Eur/Usd

1.2078

1.2109

1.1979

Short

Usd/Zar

6.2729

6.3299

6.3034

Long

Usd/Chf

1.3144

1.3115

1.3160

Short

Gbp/Usd

1.7337

1.7400

1.7361

Current Equity

$494.33

Current P/L

$0.69

Wednesday, March 01, 2006

Eur/Aud breakout

The Eur/Aud broke down below support and confirmed a test of the triangle formed over the past month. I am expecting the full run down to 100% retracement on the fibonaccis and the bottom of the channel. A stop near the 38.2 fibonacci line would give a nice risk to reward of nearly 3.5 to 1. CCI is confirming the trend, entering into the lower reversal zone and the oscillator trending itself.

For those part of the email list, you already are aware, I did not enter the Aussie trade. If you are interested in receiving email updates send an email to actsofforex@gmail.com and ask to be part of the email. If not watch for further updates.

For those part of the email list, you already are aware, I did not enter the Aussie trade. If you are interested in receiving email updates send an email to actsofforex@gmail.com and ask to be part of the email. If not watch for further updates.

Wednesday, February 22, 2006

Aussie Down Under

Much to the chagrin of gold enthusiasts, gold has pulled back over the past 5-10 days and showing uncertainty in the advance in the past 4 days. The AUD is following in uncertainty and indecision. We have a cross over on the MACD and a downward trending RSI. If the AUD/USD continues down, I would expect a move 0.7241 or 110 pip move from where we are at right now. I feel I am jumping the gun a little bit with the breakout action on the aussie has occurred after the close of the day and before the Australian market opened. The risk to reward is good with a stop loss at 0.7410. There is some support near 0.7275 that would justify a tightening of the stop loss or profit taking if the pair reaches 0.7275.

Friday, February 03, 2006

Knowledge is like money.

Knowledge is like money; the more he gets, the more he craves.- Josh Billings

That being said, I hope that to this point the ready has got some knowledge and some money and craves more as I do. The bonus in currencies is the better your knowledge the more money you can get (then crave).

There is the philosophy for the day now for the set up.

The CHF/JPY formed and broke out from a double bottom formation on 1/24. It was a nice confirming break as it paused right at the top of the middle peak and broke to the topside well beyond the 10% break I usually look for. The double bottom’s target shows 190 pip target (yellow line). It is interesting to see that the target puts us right to previous resistance. There was a small pull back today, which could turn into a reversal. I would like to see Monday as an up day before entering this trade. If Monday is stable and positive, the entry will be close on Monday or at 92.25, whichever comes first. Stop loss originally being set at 91.40 (10% of the mid channel defined by the Fibonacci lines). This is a little aggressive on the initial entry due to the 1.7 to 1 risk to reward ratio and a possible bearish divergence developing on the CCI. If the pair does not move up with any commitment, I will scrap the trade and wait for clarification. If the entry price puts me into the trade, I will watch for an approach to 93.25 (distance targeted by the double bottom). If the pair slows at resistance at all, I will tighten my stop into profitable territory maybe 92.75, locking in 50 pips with the potential of a break through to the next target near 94.25. The 94.25 would give us a 200 pip movement and some interest payments on this pair. Monday’s price movement will define this trade. See Chart.

The Eur/Aud has formed a 300 pip double top. This pair pays good interest and has a long term down trend. With an additional 40 pip move to the down side, I will enter this trade targeting the remaining 260 pips and hope it takes its time reaching the target as I get paid interest every day. There appears to be a 3 to 1 risk to reward placing the stop loss near 1.6190. See other Chart.

Have a great weekend!

That being said, I hope that to this point the ready has got some knowledge and some money and craves more as I do. The bonus in currencies is the better your knowledge the more money you can get (then crave).

There is the philosophy for the day now for the set up.

The CHF/JPY formed and broke out from a double bottom formation on 1/24. It was a nice confirming break as it paused right at the top of the middle peak and broke to the topside well beyond the 10% break I usually look for. The double bottom’s target shows 190 pip target (yellow line). It is interesting to see that the target puts us right to previous resistance. There was a small pull back today, which could turn into a reversal. I would like to see Monday as an up day before entering this trade. If Monday is stable and positive, the entry will be close on Monday or at 92.25, whichever comes first. Stop loss originally being set at 91.40 (10% of the mid channel defined by the Fibonacci lines). This is a little aggressive on the initial entry due to the 1.7 to 1 risk to reward ratio and a possible bearish divergence developing on the CCI. If the pair does not move up with any commitment, I will scrap the trade and wait for clarification. If the entry price puts me into the trade, I will watch for an approach to 93.25 (distance targeted by the double bottom). If the pair slows at resistance at all, I will tighten my stop into profitable territory maybe 92.75, locking in 50 pips with the potential of a break through to the next target near 94.25. The 94.25 would give us a 200 pip movement and some interest payments on this pair. Monday’s price movement will define this trade. See Chart.

The Eur/Aud has formed a 300 pip double top. This pair pays good interest and has a long term down trend. With an additional 40 pip move to the down side, I will enter this trade targeting the remaining 260 pips and hope it takes its time reaching the target as I get paid interest every day. There appears to be a 3 to 1 risk to reward placing the stop loss near 1.6190. See other Chart.

Have a great weekend!

Thursday, February 02, 2006

Newsletter? Updates? Something New?

Beginning of something more?

I am considering a weekly newsletter and occasionally sending out midweek emails when updating my blog. The newsletter will have additional insight not just trades but will be less dynamic in regards to trades with the blog still looking at trades specifically. If you are interested in receiving an email newsletter and occasional blog update notifications, or know someone that is, please send an email to actsofforex@gmail.com listing the email you would like me to use and I will place you on the list.

I am considering a weekly newsletter and occasionally sending out midweek emails when updating my blog. The newsletter will have additional insight not just trades but will be less dynamic in regards to trades with the blog still looking at trades specifically. If you are interested in receiving an email newsletter and occasional blog update notifications, or know someone that is, please send an email to actsofforex@gmail.com listing the email you would like me to use and I will place you on the list.

Tuesday, January 31, 2006

45 minutes to blast off

We are 45 short minutes away from Alan Greenspan’s final hurrah as Chairman of the FOMC. Coincidentally, many are speculation on interest rates and the new captain taking the helm. Because of the volatility expected from the meeting there are a couple of strategies to consider. The Eur/Usd is extremely interest rate sensitive. The Euro has climbed 60 pips in anticipation of the announcement. One may consider placing interest orders both sides of the current rate of 1.2176, 50 or more pips out, in this way, it doesn’t matter which direction the rates go as long as it is a significant move, the trade could be profitable. Another technique would be to buy exotic or fixed rate options placing one-touch positions out over 100 pips assuming a run one direction or the other. This will work if and only if the payout on one direction is higher than the cost on both of the one-touch options. The Aud/Usd will also be affected as many investors move to gold as a hedge against interest rates, if interest rates go up, the investors will run back to the interest rate or USD if interest rates stay the same or go down than the investors will stick with gold. Once again the straddled entry technique or exotic options could also be used on the Aud/Usd, keep in mind the Aussie does not move as much as the Euro so you will want to tighten up the options and/or entry positions.

Friday, January 13, 2006

Tightening stops before the weekend

USD/CAD really hasn't moved since the entry price. Tightening to 1.1675. EUR/AUD is paying us the interest so I won't be tightening it as much but still tightening to 1.6155.

Wednesday, January 11, 2006

Short the USD/CAD

Took the short position on the USD/CAD at 1.1620. 100 pip stop loss, targetting 1.1420 over the next 2 weeks. Resetting Eur/Aud short position to 1.6090

Tuesday, January 10, 2006

Quick scalp or long trade watch

For the aggressive scalper, you may be interested in jumping into the USD/CAD short for a 20 to 30 pip swing in an hour or so. For the more conservative longer-term trader, watch for a close below 1.1600. Remember this could be volatile due to Canadian elections. I am still pro commodity-based currency pairs, such as the USD/CAD short and the AUD/USD long. With a little push post elections, I would not be surprised to see the USD/CAD got to 1.1400 easily if not down to 1.1300 over the next 2 weeks. Keep an eye on these commodity currencies

Monday, January 09, 2006

Give me break

It has been a volatile few weeks with few strong signals but now we are looking for some big move breakouts.

As you know I am a fan of trading the Eur/Aud short when I am justified to trade it short. I have been waiting for this head and shoulders pattern to complete. I wanted a close below 1.6130 and we got the close below yesterday. (see image below)

Because this pattern is looking for 200 pips and gets paid 1 pip a day in interest, I like the set up and continuation of the pattern today. I am entered the trade at 1.6116. Even though the pair has moved down significantly I would still feel comfortable with a 1.6042 entry and a target of 1.5920. You will notice there are only 122 pips left in the move. I still like it. I am not putting a limit on this trade as of yet, but I will be adjusting my 125 pip stop loss as we get closer and into the pattern a little further.

I think we are going to have a great opportunity to short the USD/CAD in the next couple of days. Keep an eye on that pair.

The GBP/JPY may be setting up a head and shoulders to go short. If we close below 200.35 in the next week, we could hope for nearly 600 pip move on that pair. If not a break down I will watch for a close above 204.50 and go for 300 pips plus interest to the top side.

As you know I am a fan of trading the Eur/Aud short when I am justified to trade it short. I have been waiting for this head and shoulders pattern to complete. I wanted a close below 1.6130 and we got the close below yesterday. (see image below)

Because this pattern is looking for 200 pips and gets paid 1 pip a day in interest, I like the set up and continuation of the pattern today. I am entered the trade at 1.6116. Even though the pair has moved down significantly I would still feel comfortable with a 1.6042 entry and a target of 1.5920. You will notice there are only 122 pips left in the move. I still like it. I am not putting a limit on this trade as of yet, but I will be adjusting my 125 pip stop loss as we get closer and into the pattern a little further.

I think we are going to have a great opportunity to short the USD/CAD in the next couple of days. Keep an eye on that pair.

The GBP/JPY may be setting up a head and shoulders to go short. If we close below 200.35 in the next week, we could hope for nearly 600 pip move on that pair. If not a break down I will watch for a close above 204.50 and go for 300 pips plus interest to the top side.

Subscribe to:

Posts (Atom)