Saturday, July 21, 2007

Never Never Never let them see you sweat

Were you sweating before the weekend. Looking at the 8 hour chart you can see a range of 180 pips in the 8 morning hours. watching your potential or initial gains go from $100 down to a loss and then back to profitable in that short time period can make you nervous and make you sweat. Remember your initial analysis. The arrow is roughly where most of us got into the trade. The "small" intra-day moves don't matter in the big picture of your trade. If you are going to take a stand, stand your ground. Things are looking about where I would want it to be or expect it to be at this point. Have a good weekend.

Thursday, July 19, 2007

Kiwi video at the bottom of the page

For a 3 minute break check out the video at the bottom of the page.

mmmm Golden Kiwis

The Gbp/Nzd trade continues to test both upside and downside in the short term. I will feel much more confident of a big profitable trade if we can get a solid close below the 2.5700 area. Gold is on a move and has done so strongly finding support and breaking the downward resistance trend line. This could be a bonus to the Gbp/Nzd trade as well as the Aud/Jpy, Nzd/Jpy, Aud/Chf, Aud/Usd or just gold. There is still room to move to the top side.

Any other Gold traders out there besides me???

Any other Gold traders out there besides me???

Wednesday, July 18, 2007

Letting my mullet down

How 'bout now?

How 'bout now, can I trade it now...no how 'bout now...how bout now...and now?

So what do you do when it is near either a break out in a short term uptrend or resistance in longer term trend. GO WITH THE LONGER TERM TRADE!!!

I like the risk level now. It is about where it was yesterday as it is testing this 60 pip range going back and forth. A short position near 2.5880 with a stop up about 2.6100 seems like huge risk. Remember that the risk is 220 pips at about a 80 cents per pip or $176 per mini contract and realistically if I see a solid move beyond 2.5900, I will watch for an early exit. There is a solid resistance near 2.60 as well. These are all key levels to moderate risk for the potential target. If you are only risking the move to 2.60 that is about $100. Potential target...2.5560, 320 pips, $256. 2.5:1 risk to reward.

So what do you do when it is near either a break out in a short term uptrend or resistance in longer term trend. GO WITH THE LONGER TERM TRADE!!!

I like the risk level now. It is about where it was yesterday as it is testing this 60 pip range going back and forth. A short position near 2.5880 with a stop up about 2.6100 seems like huge risk. Remember that the risk is 220 pips at about a 80 cents per pip or $176 per mini contract and realistically if I see a solid move beyond 2.5900, I will watch for an early exit. There is a solid resistance near 2.60 as well. These are all key levels to moderate risk for the potential target. If you are only risking the move to 2.60 that is about $100. Potential target...2.5560, 320 pips, $256. 2.5:1 risk to reward.

Tuesday, July 17, 2007

It is time we met.

If you would like to sign up for this community, we can share pictures, thoughts and trades. Join the community down at the bottom right and let's meet.

GBP/NZD still a good short?

I had an email questioning whether someone in GBP/NZD trade short could hang on to the trade. It is easier for me to show my point using my blog with some images so here we are.

First, it depends on where you got into the trade. If you went short and sold near resistance (at 2.6100) you are still very profitable, if you got in the trade lower and losing money you are probably struggling right now and looking to get out.

Second, it doesn't matter where you got into the trade, either it is a good trade now or it isn't. If you are in the trade now where do you see resistance. Money gained or lost in the trade at this point has nothing to do with the current set up.

I see the resistances at 2.6100, 2.5870 and 2.5880. Any of these points could be considered for shorting opportunities. You may note that we are at or near the lowest resistance level listed which correlates to the consolidation and resistance level 4-5 days ago and the support level tested on June 28th. I like this position from a risk stand point but I like this pair has a tendency to give large shadows and test your tolerance of larger stop losses. If you aren't short a position here with a 125 pip stop seems appropriate. If we close beyond the fib fan and the 2.5900, I would still be comfortable selling it near the 2.6100 again. Low risk--Great Potential.

which correlates to the consolidation and resistance level 4-5 days ago and the support level tested on June 28th. I like this position from a risk stand point but I like this pair has a tendency to give large shadows and test your tolerance of larger stop losses. If you aren't short a position here with a 125 pip stop seems appropriate. If we close beyond the fib fan and the 2.5900, I would still be comfortable selling it near the 2.6100 again. Low risk--Great Potential.

This pair is great for practicing your long term trading strategies and getting better at understanding risk to reward ratios.

Good luck and Good Trading.

First, it depends on where you got into the trade. If you went short and sold near resistance (at 2.6100) you are still very profitable, if you got in the trade lower and losing money you are probably struggling right now and looking to get out.

Second, it doesn't matter where you got into the trade, either it is a good trade now or it isn't. If you are in the trade now where do you see resistance. Money gained or lost in the trade at this point has nothing to do with the current set up.

I see the resistances at 2.6100, 2.5870 and 2.5880. Any of these points could be considered for shorting opportunities. You may note that we are at or near the lowest resistance level listed

which correlates to the consolidation and resistance level 4-5 days ago and the support level tested on June 28th. I like this position from a risk stand point but I like this pair has a tendency to give large shadows and test your tolerance of larger stop losses. If you aren't short a position here with a 125 pip stop seems appropriate. If we close beyond the fib fan and the 2.5900, I would still be comfortable selling it near the 2.6100 again. Low risk--Great Potential.

which correlates to the consolidation and resistance level 4-5 days ago and the support level tested on June 28th. I like this position from a risk stand point but I like this pair has a tendency to give large shadows and test your tolerance of larger stop losses. If you aren't short a position here with a 125 pip stop seems appropriate. If we close beyond the fib fan and the 2.5900, I would still be comfortable selling it near the 2.6100 again. Low risk--Great Potential.This pair is great for practicing your long term trading strategies and getting better at understanding risk to reward ratios.

Good luck and Good Trading.

Monday, February 12, 2007

Just checking in

I am just checking in as I have been able to free up a little of my time. If you are out there and still checking this blog on occasion or consistently, will you please email me at actsofforex@gmail.com or post a comment to this post?

Thanks

Blake

Thanks

Blake

Wednesday, November 15, 2006

Another great site and a great book

WWW.PROFITINGWITHFOREX.COM

Profiting with Forex introduces you to all the advantages of the global foreign exchange market and shows you how to capitalize on it. You will learn why the Forex is the perfect supplement to stock and bond investing; why it is unrivaled in terms of protection, profit potential, and ease of use; and how it can generate profits, whether the other markets are up of down.

You can get there by clicking above or the link to the right.

Tuesday, September 12, 2006

In case you haven't gone their yet.

I have been posting to the INVESTOOLSCT.BLOGSPOT.COM site. This allows for you to see my postings as well as some other great traders. I will still occasionally post to this site but you should definitely visit the other too.

Boom Baby!!! GBP/JPY Bounce confirmed

We always tell people, don't try to pick the top and bottom. Play the middle. Rules were meant to be broken. I have been fortunate enough to pick near the top (click here for the top) and bottom of the recent moves on the GBP/JPY. If you would have followed my trade yesterday. (click here to see yesterdays blog) and not been "faint of heart" you would be up 150 pips and climbing. Watch for the pull backs, understand your risk and then get rid of the emotion.

Thursday, August 31, 2006

Gbp/Jpy going higher?

The Gbp/Jpy is climbing apparently in an unstable undiminished run. Analyzing the pair a little closer, there have been and will continue to be plenty of signals of reentry/position adding as the pair rockets up. Many traders are sitting on the sidelines ahead of the non farm payrolls, there is no reason to avoid trading the crosses.

From a fundamental view, is there any reason this pair will stop running in the short term. Answer: NO. Many have said the pair is too high. Let's look at the components. Is the Bank of England OK with continued strengthening of the Cable? Of course, strong currency is a good thing for the Brits. Is the Bank of Japan OK with continued weakness in the Yen? They couldn't be happier, weak currency means strong exports and strong economy for Japan. Neither of the involved reserve banks have the intention of reversing this trend. If the non farm payrolls come out tomorrow negatively or low for the US showing continued slowing in the economy, what will happen to the pair? The Gbp will strengthen a lot as it is a strong currency right now. The Yen has been weak against the USD, a weakening currency matched with a weakening currency will not cause much change and what change occurs will be outweighed by the difference between the Gbp and Usd. No worries for the announcement or current fundamentals then.

Technically, we agree with the fundamentals (see graph). We have had a consistent bouncing at the Fibonacci levels throughout this climb. It would not be surprising to see a pull back tomorrow or Monday of upwards of 250-300 pips, giving an awesome entry position before running up to the -61.8% level or to the -100% level as market on the graph. If by chance we blast through the -38.2% Fib (223.85) in the next 2 days, I would not expect the pull back until the 226 level. If the pair was aggressive enough to reach the 226 level without a pull back, I would expect the next pull back to be more dramatic, possibly to the 222 or even the 221 level from the 226 ceiling. If we get a pull back now, the odds of another aggressive 600 pip climb is greatly improved.

From a fundamental view, is there any reason this pair will stop running in the short term. Answer: NO. Many have said the pair is too high. Let's look at the components. Is the Bank of England OK with continued strengthening of the Cable? Of course, strong currency is a good thing for the Brits. Is the Bank of Japan OK with continued weakness in the Yen? They couldn't be happier, weak currency means strong exports and strong economy for Japan. Neither of the involved reserve banks have the intention of reversing this trend. If the non farm payrolls come out tomorrow negatively or low for the US showing continued slowing in the economy, what will happen to the pair? The Gbp will strengthen a lot as it is a strong currency right now. The Yen has been weak against the USD, a weakening currency matched with a weakening currency will not cause much change and what change occurs will be outweighed by the difference between the Gbp and Usd. No worries for the announcement or current fundamentals then.

Technically, we agree with the fundamentals (see graph). We have had a consistent bouncing at the Fibonacci levels throughout this climb. It would not be surprising to see a pull back tomorrow or Monday of upwards of 250-300 pips, giving an awesome entry position before running up to the -61.8% level or to the -100% level as market on the graph. If by chance we blast through the -38.2% Fib (223.85) in the next 2 days, I would not expect the pull back until the 226 level. If the pair was aggressive enough to reach the 226 level without a pull back, I would expect the next pull back to be more dramatic, possibly to the 222 or even the 221 level from the 226 ceiling. If we get a pull back now, the odds of another aggressive 600 pip climb is greatly improved.

Tuesday, July 18, 2006

Gold at a cross road

When looking at gold, I see it standing at a cross road. One direction promises a brilliant bright shiny metal future, the other direction, dimming oxidation and a lack luster existence. As gold tests the bottom of this trending support, we see a divergence has formed on the 14.3.3 stochastics and has also moved to just barely out of the upper reversal zone (78%ile at close). If Gold continues down tomorrow, I will expect drop to $600, matching the width of the channel, the gap from 2 weeks ago and the consolidation in April. A further move could push Gold lower to $550, 2 channel widths and the prevailing support level from January through March.

A bounce off of the current channel or the 38% Fibonacci line at about $620 could be the confirmation to see Gold continue the bullish run back to the top of the channel near $680 if not the highs hit in May at $740. I would be willing to accept either direction with some confirmation. Tomorrow very likely will offer the clarity needed for a big move and sizable profitability.

My personal bias is to see Gold follow the divergence and stochastics losing ground and pushing to the bottom side. If you don’t have a futures account or account to trade spot gold, look at the AUD which is back in line with gold pricing after fighting the bullish move in gold previously in the year, the AUD seems to be correlated again. If you are looking to play gold weakness with the AUD but aren’t convinved that the USD can continue, look at the set ups with the AUD/JPY and the EUR/AUD, both are also at key levels of support/resistance.

A bounce off of the current channel or the 38% Fibonacci line at about $620 could be the confirmation to see Gold continue the bullish run back to the top of the channel near $680 if not the highs hit in May at $740. I would be willing to accept either direction with some confirmation. Tomorrow very likely will offer the clarity needed for a big move and sizable profitability.

My personal bias is to see Gold follow the divergence and stochastics losing ground and pushing to the bottom side. If you don’t have a futures account or account to trade spot gold, look at the AUD which is back in line with gold pricing after fighting the bullish move in gold previously in the year, the AUD seems to be correlated again. If you are looking to play gold weakness with the AUD but aren’t convinved that the USD can continue, look at the set ups with the AUD/JPY and the EUR/AUD, both are also at key levels of support/resistance.

Monday, June 26, 2006

USD/JPY

Entry order expecting a break above highs over the 116.60 market with a target 118.30. This plays into major resistance and fibonnaci retracement levels. Stop near 115.50

The Eur/Usd is trying to tempt me to trade this long yet I am not really comfortable with the FOMC meeting on Friday. I am thinking of putting 100 pip entry orders both directions on the pair. Expecting a significant move back to the top of the channel or a breakout. It may remain flat all the way through Thursday.

Gold is relatively flat. Watch for a break above 602 and then a move to 610. A break above 612 watch for a move all the way to 635. The Aud/Usd is right near the 61% fib. If this bounces and gold breaks it could be a major reversal all the way back up to .7600 or higher over the next month or two. A break below could drop us to .7000. Short at .7250 with a stop .7380. If it breaks up with gold through .7430, I will be more aggressive and get in long.

Watch the Usd/Cad. Appears to be setting up for a bounce down. Pivotal point.

Blake Young

Random Acts of Forex

Tuesday, June 13, 2006

Eur/Usd

Still waiting for a break/close below the 1.2550 level on the Eur/Usd. Same level mentioned earlier. Maybe an entry today, we are only 17 pips away right now. I am also looking at the Usd/Cad for a short position. This pull back could give a good entry price. Let's see what happens in the next 5 hours.

Blake Young

Random Acts of Forex.

Wednesday, June 07, 2006

He's ALIVE!!!

Surprisingly, I am back. After finding good homes for my dogs, selling my house, moving to another house and launching trading rooms and the new OEC, I have carved out time for a posting. I felt this was very important to do as the ECB rate decision is due out in the morning. This decision comes at a very critical time. We had nearly a 750 pip run on the dollar but sentiment is uncertain. Many traders are still very bearish but I wonder if that is nearing an end. If the ECB raises rates higher than the expected, this could lead to a possible dollar catastrophe/panic. If the announcement is disappointing, it could be the catalyst to reverse the run. Taking a more conservative approach to the trade and waiting for a clear break out of the bull flag I see an entry at 1.30 with a target of 1.36 over the next 2 months, the reverse would be a close below 1.2550 and a target of 1.1950. See chart

6/8/2006

7:45 est

EU

ECB Announces Interest Rates

2.75% expected

2.50% previous

The other big trade I am watching is the Chf/Jpy. The pair has broke out of the ascending triangle and appears to be going for a small retest. A sudden move up could be justification for a long position and 250-350 pip target. See chart

I hope all is well, wish you the best of success and hope you are able to "print" some money on tomorrow's announcement.

Blake Young

Random Acts of Forex

actsofforex@gmail.com

6/8/2006

7:45 est

EU

ECB Announces Interest Rates

2.75% expected

2.50% previous

The other big trade I am watching is the Chf/Jpy. The pair has broke out of the ascending triangle and appears to be going for a small retest. A sudden move up could be justification for a long position and 250-350 pip target. See chart

I hope all is well, wish you the best of success and hope you are able to "print" some money on tomorrow's announcement.

Blake Young

Random Acts of Forex

actsofforex@gmail.com

Tuesday, May 16, 2006

Bad time for an update

I know this is not the most opportune time for an update but I haven't had much time the past 2 days. I was stopped out of all my trades over the weekend and on Monday. I am getting back into gold. Looking for an entry on silver near 13.90 and then again at 14.05. Looking for a short position on the Cad/Jpy at 98.22. I am looking for a long position on the Eur/Usd at 1.2881. Looking for a short position on the Usd/Jpy 109.20. Straddling the Eur/Aud-- Long if it goes over 1.6860 and short if it goes below 1.6650.

I am really deliberating on a short position on the Eur/Chf. Gut feeling says it is a short position right now.

Instead I think I may just short the Usd/Chf. Can decide yet on this one. This would be a short 40 pip grab. If I wait and see the Eur/Chf go below 1.5450, this would be more sizable and maybe take us down to 1.5260 .

While typing this, my gold position has moved positive making up a large night time spread and is up $30 from yesterday's lows. Could be big day for the Aud/Usd. A push above 0.7740 will place me in a long trade anticipating a move higher to 0.8150 over the next 2 weeks.

Best of success

Blake Young

Random Acts of Forex

Thursday, May 11, 2006

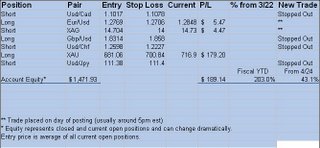

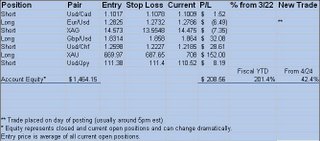

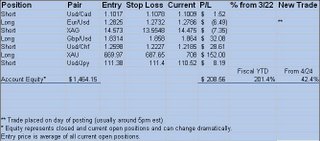

Updated Positions

Wednesday, May 10, 2006

Wild ride from the FOMC

Up and down up and down,... up??? The news appeared to have a net zero effect on the market. Lots of whip saw on the event. I was stopped out of the Eur/Usd again and then got back in. So I grabbed a couple of dollars and re-entered the trade. Also added to the Gold and back in on Silver. Remember you can trade IAU and SLV if you would like to trade the ETFs/iShares for gold and silver.

We are back over 200% again and still have 2 weeks to go for the end of month two. With gold and silver breaking out, I think we have a good chance.

Good luck in your trading.

Blake Young

Random Acts of Forex

We are back over 200% again and still have 2 weeks to go for the end of month two. With gold and silver breaking out, I think we have a good chance.

Good luck in your trading.

Blake Young

Random Acts of Forex

Tuesday, May 09, 2006

Testing Barriers and stop losses

This morning there has been a bit of volatility as many currency pairs have pushed to the years or multiple year extremes. These attempts have included a bit of volatility and I have been stopped out of a number of trades and still have signals to get back in to the trades. This can be aggravating to be stopped out and have the trend continue, but it is better than taking to much risk. So, even though I was stopped out of the Eur and the Cad, I am back in those trades.

I have added to my gold position as gold makes an attempt at $700. This could be big. About 6 months ago I commented to a number of trader friends that I wouldn't be surprised if gold broke $1000 within 2 years. It certainly appears to be headed that direction.

Now pay attention here. FOMC Interest rate announcement. What is it going to be? Even though Bernanke said he may be done raising rates, analysts are expecting we are going to get another rate hike to put the discount rate to 5%. If the analysts are right and the market is expecting this, imagine the implication if there is a no rate hike. If the market has priced in the hike and their is no hike, we could see 150-200 pip move after the announcement. The question is, is the Eur/Usd reflecting expectations of a hike, no hike as Bernanke hinted at, or something in between. No matter what happens, I expect a lot of action tomorrow. Maybe a good scalping time. This could be another reason to play gold, due to uncertainty.

Below are the current positions. Note the entry price has changed due to new positions or adding to previous positions.

I have added to my gold position as gold makes an attempt at $700. This could be big. About 6 months ago I commented to a number of trader friends that I wouldn't be surprised if gold broke $1000 within 2 years. It certainly appears to be headed that direction.

Now pay attention here. FOMC Interest rate announcement. What is it going to be? Even though Bernanke said he may be done raising rates, analysts are expecting we are going to get another rate hike to put the discount rate to 5%. If the analysts are right and the market is expecting this, imagine the implication if there is a no rate hike. If the market has priced in the hike and their is no hike, we could see 150-200 pip move after the announcement. The question is, is the Eur/Usd reflecting expectations of a hike, no hike as Bernanke hinted at, or something in between. No matter what happens, I expect a lot of action tomorrow. Maybe a good scalping time. This could be another reason to play gold, due to uncertainty.

Below are the current positions. Note the entry price has changed due to new positions or adding to previous positions.

Subscribe to:

Posts (Atom)