I feel a little bit like I am going down the rabbit hole with my new effort.

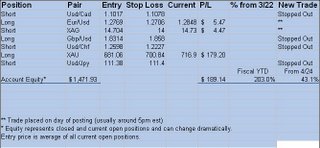

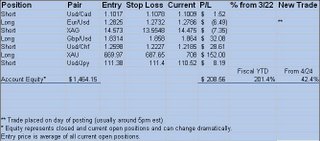

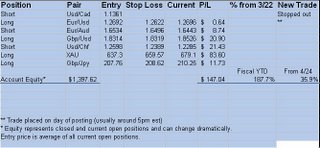

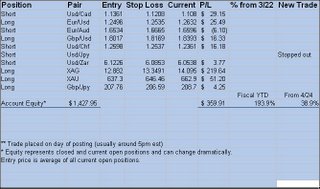

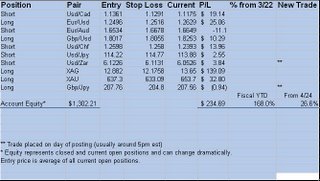

Effective 3-22-06, I will be posting all of my trades and running account values using some money management.

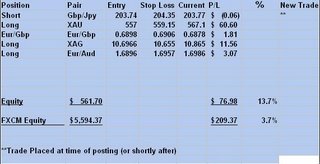

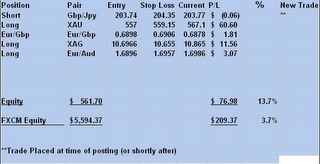

I have had people ask if it is possible to trade the forex with very little money. I am going to trade a $500 account with a dealer that allows base 10 or unit based trading.

What does unit based trading mean? This means that if I have $500 (493.60 after transfer fees) account and have a trade where I would normally place 2.5% at risk, I can actually invest $12.50 in the trade by investing 1,250 units or 12.5% of a mini contract. Unit trading allows exact money management.

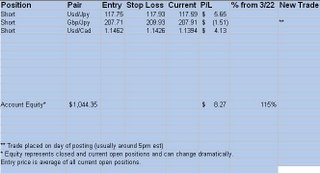

For those that are using a dealer that trades based on mini and full size contract, I will be starting with $5385 and be buying 2 mini contracts for most trades.

I decided it is time to show that a conservative approach in the currency market can still generate good returns whether you are trading a small account or if you are trading a large account. As such I will not post my scalps or more other account, just the accounts as described above.

Because I am posting account results, I may miss a trade posting but all trades can be verified by the account report.

Be aware that if I post a trade late I will post my actual entry price and exit price and can verify the time if you are interested. There may be a little disparity between the two accounts as I am manually placing the orders and stops and they have different spreads.

The smaller account allows for trading the spot gold and spot silver markets as well as the South African Rand (Usd/Zar) where the FXCM $5385 does not. I will be taking gold and silver and USD/ZAR trades on the smaller accounts.

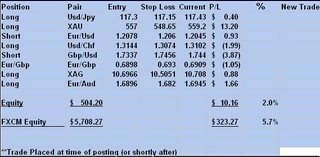

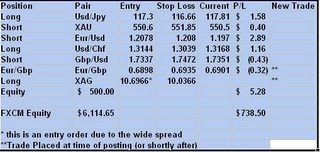

My current positions consist of:

Position

Pair

Entry

Stop Loss

Current

Long

Usd/Jpy

117.3

116.42

117.69

Short

XAU (gold)

550.6

552.90

551.00

Short

Eur/Usd

1.2078

1.2109

1.1979

Short

Usd/Zar

6.2729

6.3299

6.3034

Long

Usd/Chf

1.3144

1.3115

1.3160

Short

Gbp/Usd

1.7337

1.7400

1.7361

Current Equity

$494.33

Current P/L

$0.69